Phone: Austin: 512-219-8148, Houston: 832-426-2727

Dallas: 214-666-8346, San Antonio: 210-775-5697

Email: info@austinfirstmortgage.biz

Credit Score

A credit score (also called a FICO Score, so named for the company that provides the score used by 90% of lenders) helps lenders determine their risk in lending you money. Your history of paying bills on time and your monthly debts determine your credit score, which can range from 300 (worst) to 850 (best). A score of 740 or above is generally considered "excellent."

There are three national credit bureaus (Equifax, Experian and TransUnion) that maintain credit reports. FICO summarizes the results into three FICO scores, one for each bureau. Usually, the three scores are similar, but they may differ based on the different information collected by each credit bureau.

Finding out your credit score

For a fee, FICO will provide you with your credit score(s) upon request. You can also get one free copy of your credit reports from each credit bureau every 12 months via annualcreditreport.com. You're allowed to dispute information in the reports if it was recorded incorrectly, so it's a good idea to check your credit reports regularly for errors - especially if you're planning a major purchase like a house.

What's in my credit report?

Debts such as credit cards, auto loans, student and personal loans automatically show up in your credit reports. Creditors decide whether or not to report late payment. If you're late, you can call the organization to ask about their policies and whether your payment was reported.

Maintaining good credit

Paying your bills on time as a matter of habit is the best way to ensure your credit remains healthy. Many creditors report after 30 days past due, while others wait as long as 90 days. Healthcare providers usually don't report until much later, if at all.

A word of caution

Each time you apply for a loan or credit card, it gets reported to the credit bureaus. When lenders see multiple applications reported in a short period of time, it can discourage them from giving you a loan.

How important is my credit score?

Your credit score is very important but it is only one factor in a mortgage application. Lenders also consider your income, employment history, your current monthly debts, the size of the loan and your down payment. If your credit score isn't where you want it to be, you can improve it over time.

Trying the Home Affordability Calculator, talking to a mortgage loan originator, and mortgage prequalification are a few ways to start assessing your borrowing power.

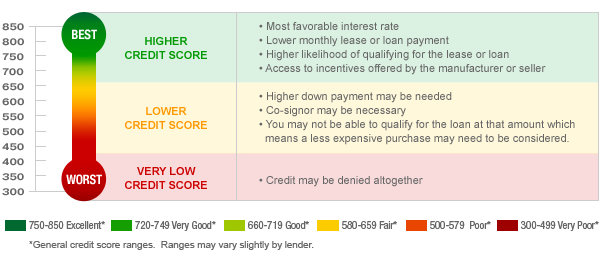

What credit score do I need to get a mortgage?

Although there isn't a specific minimum credit score required for a mortgage loan, it's important to maximize your score before starting the home-buying process in order to qualify and secure the best mortgage rate. Government-backed mortgages like FHA loans typically have lower credit requirements than conventional fixed-rate loans and ARMs.

Austin First Mortgage - Where mortgages are only the beginning

Quick Links

Address

Austin First Mortgage

13284 Pond Springs Road, Ste 204, Austin, TX 78729

(512) 219-8148

info@austinfirstmortgage.bizNMLS License Info

AAXY LLC dba Austin First Mortgage | NMLS# 275971

Yinan Nancy Sun | NMLS# 322282

Copyright © 2015-2020 Austin First Mortgage